Is the Gateway solution

right for me?

Select the answers that best describe your business to get started.

Fully supported payment infrastructure for enterprise applications

Multi-user access control tailored to suit your business

Reconcile transactions and view intuitive reports from a single dashboard

Acquirer agnostic across all major institutions in South Africa

Why we are leaders in the digital economy

With infrastructure designed to support complex applications, our gateway solution provides peace of mind to not only some of South Africa’s largest online retailers, but also to the leading banking institutions in the country, as a trusted online payment gateway.

Plugins & Shopping Carts

Built by developers, our gateway solution offers integrations into leading plugins, shopping carts, and booking systems for safe and quick deployment.

PCI DSS level 1

Protect card holder data with the highest level of compliance achievable in the industry.

Proactive fraud and data security

We are trusted by some of South Africa’s leading enterprises to securely manage and process their digital transactions with our proactive approach to fraud and cybersecurity.

Gateway payment methods

Our online payment methods offers you the ability

to accept payment securely from multiple localised payment methods and globally recognised card associations.

Fully supported payment

infrastructure

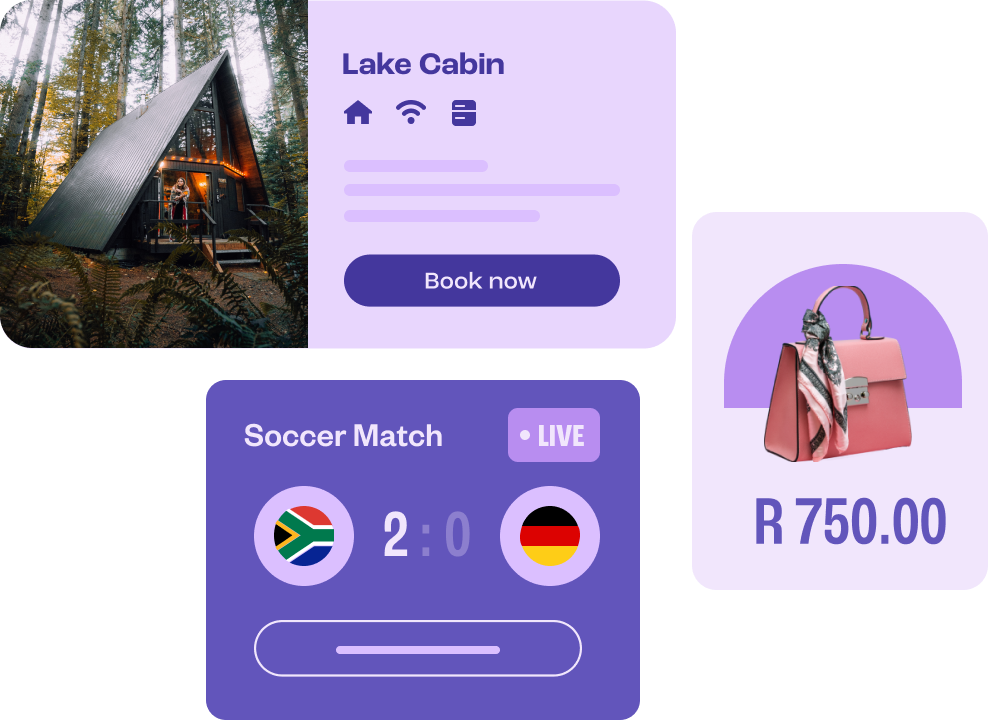

With years of technical experience, we continuously enhance our systems to support some of South Africa’s largest industries such as tourism, gaming and retail. Our sales team offers support for the most bespoke solutions.

Built by developers, for developers

Designed with developers in mind, we take the guess work out of choosing

the right solution for your client or your business with easy to use APIs and pre-built integrations

Payweb

An easy and secure way for a customer to make payments via a hosted payment page on the merchant’s website.

Payhost

Our enterprise API provides flexible integration with a host of applications supporting ecommerce, mobile payments and many more.

Payweb

An easy and secure way for a customer to make payments via a hosted payment page on the merchant’s website.

Payhost

Our enterprise API provides flexible integration with a host of applications supporting ecommerce, mobile payments and many more.

Difference between aggregation and gateway

Choosing between a Payment Aggregator and Payment Gateway is an important decision for your business. We’ve taken a bit of the guess work out to show you a few key differences.

payfast

Aggregation

- Plug and play shopping cart or custom integration options available

- Onboarding between 24 to 48 hours

- Net settlement every 48 hours

- Alternate payment methods available immediately on a verified account

- Caters for small to medium enterprises

- Scalable solutions offered for larger enterprises requiring unique integrations

paygate

Gateway

- Ecommerce Shopping Cart Plugins and integrations with leading travel & hospitality booking engines

- Non redirect integration options available for PCI compliant merchants

- Bank dependent onboarding

- Real-time gross settlement

- Alternate payment methods direct with providers

- Suited to enterprise and complex business applications

- Merchants process through their own banking relationship

- Virtual Point of Sale available to process card not present transactions